Mikko Huimala

Partner@hannessnellman.com

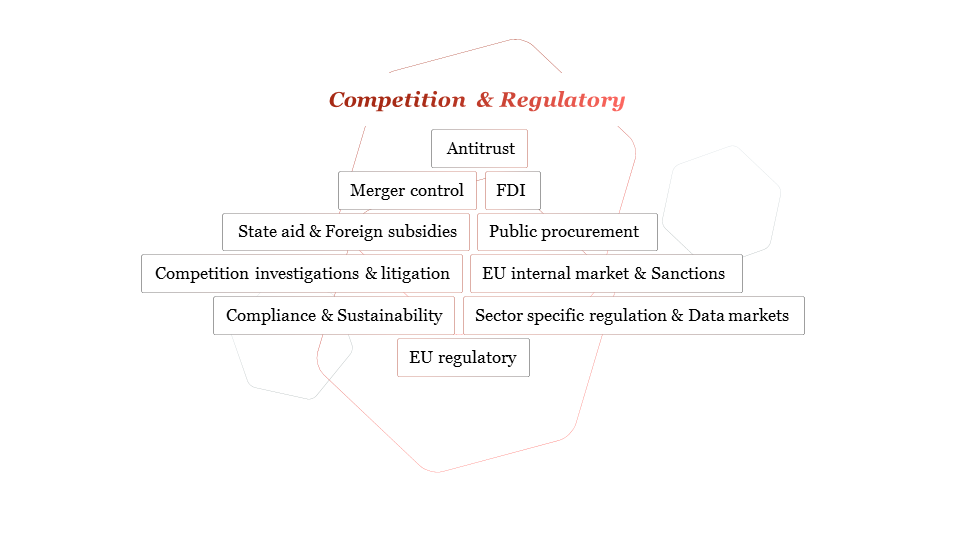

We regularly advise on critical competition, regulatory, and compliance related matters, and we are recognised and highly ranked by our clients and peers in the competition and regulatory fields.

While the assignments are often challenging and complex, we also support our clients in swiftly solving their everyday practical issues.

We have exceptionally extensive experience of both international and domestic cases in a wide range of areas, including:

Our team members have diverse backgrounds from in-house legal roles, enforcement authorities and regulators, as well as economics, which is reflected in the hands-on practical approach of serving our clients.

Our public procurement team is happy to assist you on matters relating to public procurement tendering competitions, direct awards, disputes and more.

Sampo plc and Topdanmark A/S

Sampo plc's recommended public exchange offer for the shares in Topdanmark A/S

DKK 33 billion

Counsel to Sampo plc

Cargotec Corporation and Kalmar Corporation

Cargotec’s partial demerger and separation of Kalmar

Approx. EUR 2.0 billion (illustrative carve-out sales)

Counsel to Cargotec Corporation and Kalmar Corporation

Parties:

Prime Minister’s Office, Finnair Plc

Transaction:

Hannes Snellman acted as counsel to the Prime Minister’s Office in the rights offering of Finnair Plc, the Finnish airline with the State of Finland being the majority owner. Hannes Snellman advised, among other, on the share subscription made by the State of Finland by way of offsetting, in part, a capital loan provided by the State of Finland to Finnair, and related state-aid law matters. The rights offering of EUR 570 million is one of the largest rights offerings in Finland in recent years.

Deal value:

Approximately EUR 570 million

Role:

Counsel to Prime Minister’s Office

Hannes Snellman acted as counsel to Oriola Oyj (“Oriola”) in the sale of Svensk dos AB to Apotekstjänst Sverige AB. The agreed sale price in cash is SEK 110 million, and Oriola will through the transaction exit the dose dispensing business in Sweden.

Uponor Corporation (target), Georg Fischer Ltd (buyer)

Counsel to Uponor Corporation in the recommended public cash tender offer by Georg Fischer Ltd to purchase all of the issued and outstanding shares of Uponor Corporation.

EUR 2.1 billion

Counsel to Uponor Corporation

Sega Europe Limited and SEGA Corporation (Buyers) Rovio Entertainment Corporation (Target)

Counsel to Sega Europe Limited and SEGA Corporation in the recommended public cash tender offer for all shares and options in Rovio Entertainment Corporation.

Approximately EUR 706 million

Counsel to Sega Europe Limited and SEGA Corporation

Equip Capital, Lakers Group AB, Vestum AB

Equip Capital has acquired a portfolio of companies from Lakers Group by Vestum AB

Value not public

Counsel to Equip

A consortium consisting of Security Trading, Fennogens Investments, Corbis, and Bain Capital (buyer), Caverion Oyj (Target)

Counsel to the offeror consortium consisting of Security Trading, Fennogens Investments, Corbis, and Bain Capital in the recommended public cash tender offer for all shares in Caverion Oyj.

EUR 955 million

Counsel to the offeror consortium consisting of Security Trading, Fennogens Investments, Corbis, and Bain Capital

Cargotec Corporation, Konecranes Plc

The announced, but subsequently abandoned, merger of Cargotec and Konecranes in 2021-2022

Approx. EUR 2.7 billion

Counsel to Konecranes Plc

The German State (Buyer), Fortum Oyj (Seller), Uniper SE (Target)

Fortum Oyj’s arrangements related to stabilisation of its German subsidiary Uniper SE. The package will ensure multi-billion funding for Uniper, sale of Fortum’s shareholding in Uniper to the German State for approximately EUR 0.5 billion as well as repayment of Fortum’s EUR 4 billion receivables from Uniper and release of EUR 4 billion parent company guarantees.

Approx. EUR 4.5 billion

Finnish counsel to Fortum Oyj

Stora Enso Oyj, UPM-Kymmene Group, Metsä Group, Sonoco-Alcore, other sellers (Sellers), Stena Recycling Oy (Buyer), Encore Ympäristöpalvelut Oy (Target)

Sale of Encore Ympäristöpalvelut Oy to Stena Recycling Oy

Value not public

Counsel to Stora Enso Oyj, UPM-Kymmene Group, Metsä Group, Sonoco-Alcore, and other sellers

Esperi Care (target), Danske Bank, SEB, and Ilmarinen (majority owners), Triton (buyer)

Counsel to Esperi Care and its majority owners Danske Bank, SEB, and Ilmarinen in the acquisition of the majority of Esperi Care’s shares by Triton Smaller Mid Cap Fund II advised by Triton.

Value not public.

Counsel to Esperi Care and its majority owners

Ahlström Capital BV and Nidoco AB (buyers), Ahlstrom-Munksjö (seller), Decor Solutions business area (target)

The buying consortium comprising Ahlström Capital BV and Nidoco AB, in the investment in the majority share of Ahlstrom-Munksjö’s Decor Solutions business area.

Value not public

Counsel to the buying consortium (Ahlström Capital BV and Nidoco AB)

Basware Corporation (target), a consortium consisting of Accel-KKR, Long Path Partners, and Briarwood Chase Management (buyer)

Counsel to the offeror consortium of Accel-KKR, Long Path Partners, and Briarwood Chase Management in the tender offer for all outstanding securities in Basware Corporation.

EUR 620 million

Counsel to the consortium

Anora Group Plc (Altia Plc, Arcus ASA) and Galatea AB

Required pre-closing divestment of Altia’s brands Skåne Akvavit, Hallands Fläder, and Brøndums and cognac brand Grönstedts (along with Arcus’s aquavit brand Akevitt Spesial and spirits brands S.P.R.T. and Dworek) to Galatea AB. The divestment to a suitable buyer was required by the Finnish, Norwegian, and Swedish competition authorities as a condition to their approval of the merger between Altia and Arcus to form Anora Group.

Not public

Lead counsel to Altia Plc (Anora Group Plc)

Altia Plc, Arcus ASA

Merger of Altia Plc and Arcus ASA to form Anora Group

Preliminary aggregated annual revenue EUR 640 million

Lead counsel to Altia Plc

Assemblin, Tom Allen Senera

Counsel to Assemblin in its acquisition of Tom Allen Senera, a Finland-based systems supplier of energy solutions to properties.

Value not public

Counsel to Assemblin

Virala Acquisition Company Plc, Purmo Group Ltd

Virala Acquisition Company Plc's merger with Purmo Group Ltd.

EUR 685 million

Counsel to Virala Acquisition Company Plc

Valmet, Neles

Hannes Snellman acted as lead counsel to Valmet, a leading global developer and supplier of process technologies, automation, and services for the pulp, paper, and energy industries, in its merger with Neles, one of the leading providers of mission-critical flow control solutions and services for process industries in Finland.

The combined value of the merging companies is approximately EUR 7 billion.

Lead counsel to Valmet

The State of Finland, Finnair Plc

Counsel to the State of Finland in the hybrid loan arrangement with Finnair Plc

Up to EUR 400 million

Counsel to the State of Finland (Prime Minister’s Office)

PPG Industries, Inc. (Bidder), Tikkurila Oyj (Target)

Recommended public cash tender offer for all of the shares in Tikkurila by PPG Industries, Inc.

EUR 1.5 billion

Counsel to Tikkurila Oyj

Telia Finland (Seller) and AddSecure (Buyer)

Telia Finland’s divestment of Telia Alerta business to AddSecure

Value not public

Counsel to Seller/Telia Finland

Counsel to Altia in competition law risk assessment and compliance review.

Counsel to Nordea Life in a competition law compliance matter.

Ahlstrom-Munksjö Oyj (target), a consortium consisting of Ahlström Capital, Bain Capital Private Equity, Viknum and Belgrano Inversiones (buyer)

Recommended public cash tender offer for all shares in Ahlstrom-Munksjö Oyj by Spa Holdings 3 Oy

Approximately EUR 2.1 billion

Counsel to the consortium

Counsel to CBRE in competition and compliance related matters.

Sanoma Media Finland Oy (Seller), Schibsted (buyer), Oikotie Ltd (target)

The sale of Sanoma’s online classifieds business Oikotie to Schibsted

EUR 185 million

Counsel to Sanoma Group

Riikka Rannikko, Jesper Nevalainen, Mikko Huimala, Agda Vähä-Piikkö, Jenni Heurlin, Anton Pirinen

City of Espoo, Kumppanuuskoulut Oy, YIT Oyj, Meridiam Investments II

The City of Espoo signed a service agreement with Kumppanuuskoulut Oy on the implementation of five schools and three daycare centres

Approx. EUR 300 million

Counsel to City of Espoo

Rabbe Sittnikow, Jussi Ekonen, Janna Pihanurmi, Janne Veneranta, Roosa Väre, Markus Bremer, Maria Landtman, Samuli Pirinen, Heikki Vesikansa, Harri Vehviläinen, Piia Ahonen, Joakim Lavér

Comprehensive advice on the state aid law for the Prime Minister’s Office concerning the recapitalisation (rights offering) of the state-controlled airline Finnair Plc, including advise on the notification procedure before the European Commission. The rights offering of 500 MEUR is one of the largest rights offerings in Finland in recent years. The Commission’s decision in the case lead to amendments to the COVID-19 related State Aid Temporary Framework.

Series of compliance trainings for Nordea in the area of competition law and compliance.

Outotec Oyj, Metso Corporation

The combination of Outotec and Metso Minerals through a demerger

EUR 3.9 billion (illustrative combined sales)

Counsel to Outotec Oyj

Wereldhave N.V. (Seller), Morgan Stanley Real Estate Investing (MSREI) (Buyer)

Wereldhave's divestment of the Itis shopping centre to a fund advised by Morgan Stanley Real Estate Investing (MSREI)

Approx. EUR 520 million

Counsel to Wereldhave N.V.

Orion Corporation (Seller), Axcel Management A/S (Buyer), Orion Diagnostica Oy (Target)

Orion Corporation's divestment of the diagnostics business unit Orion Diagnostica Oy to a private equity fund managed by Axcel Management A/S

Value not public

Counsel to Orion Corporation

OP Financial Group (Seller), Vienna Insurance Group (Buyer), Seesam Insurance AS (Target)

OP Financial Group's sale of the non-life insurance company Seesam Insurance AS (Seesam), including its Latvian and Lithuanian branches, to Vienna Insurance Group (VIG)

Value not public

Counsel to OP Financial Group

Nordic Packaging and Container Holdings (Seller), Mondi Group (Buyer), Powerflute Group Holdings Oy (Target)

Nordic Packaging and Container Holdings' sale of Powerflute Group Holdings Oy to a division of Mondi Group

Enterprise value of EUR 365 million

Counsel to Nordic Packaging and Container Holdings (NPAC Holdings)

Lemminkäinen Corporation and YIT Corporation

The combination of Lemminkäinen Corporation and YIT Corporation through a statutory merger

EUR 771 million

Counsel to Lemminkäinen

Oriola Oyj and Kesko Oyj

A 50/50 percent joint venture to establish a chain of health, beauty and wellbeing stores across Finland, with the plan to expand the business to include pharmaceuticals if the legislation is amended

Value not public

Counsel to Oriola

Counsel to a major transportation company in an abuse of dominant market position and state aid case related to subventions allegedly received by a competitor.

Counsel to a Finnish public fund in state aid and competition law aspects of its major business development program.

Counsel to the complainants in the first state aid complaint to the European Commission against a Finnish municipal enterprise. According to the Commission’s preliminary view, the benefits granted to the municipal enterprise constitute state aid.

Counsel to a public company against the State of Finland in state aid recovery proceedings before the Finnish Administrative Courts. This is the first case where the European Commission’s negative state aid decision has led to national recovery proceedings being initiated in Finland against the recipient undertaking of the alleged unlawful aid.

Counsel to a Finnish listed company against the European Commission in the first-ever state aid litigation involving Finnish parties. The dispute concerned whether the State of Finland violated the EC Treaty by granting unlawful state aid to our client. The Court of First Instance of the European Communities (“CFI”) ruled in favour of our client and annulled the Commission’s decision on alleged state aid. The Commission decided not to appeal against the CFI’s judgement.

Counsel to a number of parties in state aid complaints against Finnish municipal enterprises.

Counsel to a leading bank in its acquisition of a listed insurance company, notifying the deal to the FCA and coordinating multi-jurisdictional filings.

Counsel to a leading telecommunications company in a complex merger control case, which was conditionally cleared by the FCA. Following appeals by several competitors, the transaction was prohibited. In an important precedent, the Supreme Administrative Court overturned the decision as the competitors were deemed not to have any right of appeal, which thus enabled our client to successfully complete the transaction.

Counsel to an international conglomerate in its acquisition of a public Finnish company. The transaction was notified to the European Commission, which made a conditional Phase 1 clearance decision, thus enabling our client to close the transaction within the desired timetable.

Counsel to a leading retailer in setting up a Baltic joint venture, including the first merger control notification to the European Commission concerning the Baltic countries post-enlargement.

Counsel to an international media group in its acquisition of first joint and subsequently sole control of a leading Finnish media company, both stages including multi-jurisdictional filings.

Counsel to a globally active company in its acquisition of another public company through a tender offer, handling the notification to the European Commission and coordinating the national filings in jurisdictions outside the EU.

Counsel to the notifying party in two separate media transactions, both unconditionally cleared by the Finnish Competition Authority (FCA) following in-depth Phase 2 investigations.

Counsel to two international paper manufacturers in a transaction that was notified to the European Commission and a number of national competition authorities outside the EU. After Phase 2 proceedings, the Commission cleared the transaction without any conditions.

Counsel to a private equity investment firm in relation to the merger of its portfolio company with a competitor, notifying the deal to the competition authorities in Finland, Sweden, Norway, Russia, Poland and Germany.

Counsel to an international private equity investment firm on the acquisition of a Finnish grocery retailing chain. The transaction was notified to and cleared by the European Commission.

Counsel to a public company on the competition law aspects of a joint venture with a competitor. The transaction was notified to and cleared by the competition authorities in Finland, Sweden, Norway, Poland, Estonia, Russia and Ukraine.

Counsel to Sentica’s portfolio company Trust Kapital, a company specializing in receivables lifecycle management and financing, in its acquisition of Enfo Zender, Enfo Oyj’s information logistics subsidiary.

Counsel to Henri Juva in the sale of a majority of shares in Quattro Mikenti Group Oy to Adelis Equity Partners Fund I AB by Henri Juva and other sellers.

Counsel to Kesko Corporation in securing unconditional merger control clearance from the Finnish Competition and Consumer Authority for its acquisition of Kalatukku E. Eriksson Ltd., a Finnish fish processor and wholesaler.

Counsel to a Finnish listed company against the Finnish Competition Authority in complex administrative proceedings concerning the authority’s obligation to produce documents to the parties involved in regulatory investigations. Our team of specialists successfully represented the client before the Supreme Administrative Court and obtained a precedential decision extending the parties’ access to documents.

Counsel to a major telecommunications company in court proceedings relating to a decision by the Finnish Communications Regulatory Authority, which had found our client to have significant market power in the market for call termination. Upon appeal, the Supreme Administrative Court annulled that decision and remitted the matter for new appraisal.

Counsel to one of the leading mobile operators in proceedings against another mobile operator who required access to our client’s mobile network. A successful outcome was achieved as both the FCA and the appeal court held that our client did not have any obligation to grant access to its network.

Counsel to a Finnish bank in EU cartel proceedings. The Commission alleged that our client – together with various other European banks – had infringed EU competition law by agreeing on charges for the exchange of Euro-zone currencies. The Commission dropped the case after we had successfully defended the client bank’s position.

Counsel to a major telecommunications company in three closely related court and arbitration proceedings in which certain other telecom companies claimed damages exceeding MEUR 500 from our client. They alleged that our client had abused a dominant position. All three private enforcement actions were successfully settled out of court.

Counsel to a listed Finnish company in complex cartel investigations by the FCA. Following proceedings that lasted more than four years – encompassing numerous requests for information, interviews and a statement of objections – the FCA closed the case without making any penalty payment proposal to the Market Court.

Counsel to a multinational company in a case where the FCA had proposed that the Market Court should impose a fine for alleged restrictions of parallel imports in the market for digital cameras. Both the Market Court and the Supreme Administrative Court rejected the penalty payment proposal in its entirety.

Counsel to a Finnish listed company against the FCA in the largest-ever cartel proceedings brought before Finnish courts, where the proposed fines on the basis of alleged bid-rigging and market sharing amounted to MEUR 97.

Counsel to a leading company in a matter concerning alleged resale price maintenance, to date the largest case in Finland concerning vertical restrictions.

Counsel to a public company in a cartel investigation, where the Finnish Competition Authority (FCA) ceased the handling of the case without finding any infringement.

Counsel to an international company in private enforcement litigation, where the claimant seek damages from our client alleging that the agreement between the parties infringed competition rules. In one of the first private enforcement rulings by Finnish general courts, the District Court ruled in favour of our client dismissing all claims. Upon appeal, the Court of Appeal upheld the decision.

Counsel to clients in a number of large pending public and private enforcement procedures.

Counsel to a leading consumer goods retailer in large-scale self-assessments of its activities previously based on numerous exemptions granted by the Finnish Competition Authority.

Counsel to a global company in an extensive competition law audit, comprising document review and interviews, and covering the Nordic countries and Russia.

Counsel to a public company in a group-wide compliance program, including compliance training sessions in Finland, Sweden and the Netherlands.

Counsel to an international group executing a large-scale compliance program. Our tasks comprised competition law audits, multiple compliance training sessions in several countries, the preparation of compliance manuals and dawn raid guidelines, and the creation of internal review and follow-up systems.

Counsel to a Finnish listed company against a state-owned company in a landmark damages litigation regarding the compensation of direct and indirect losses under the Finnish Sale of Goods Act. The case resulted in a precedent issued by the Supreme Court of Finland.

Counsel to the claimant in a precedent appeal to the Supreme Administrative Court against the Finnish Government’s decision to allocate radio licences.